简单、灵活、安全的跨境收单服务

PayPal全球收单-标准版

PayPal全球收单-高级版

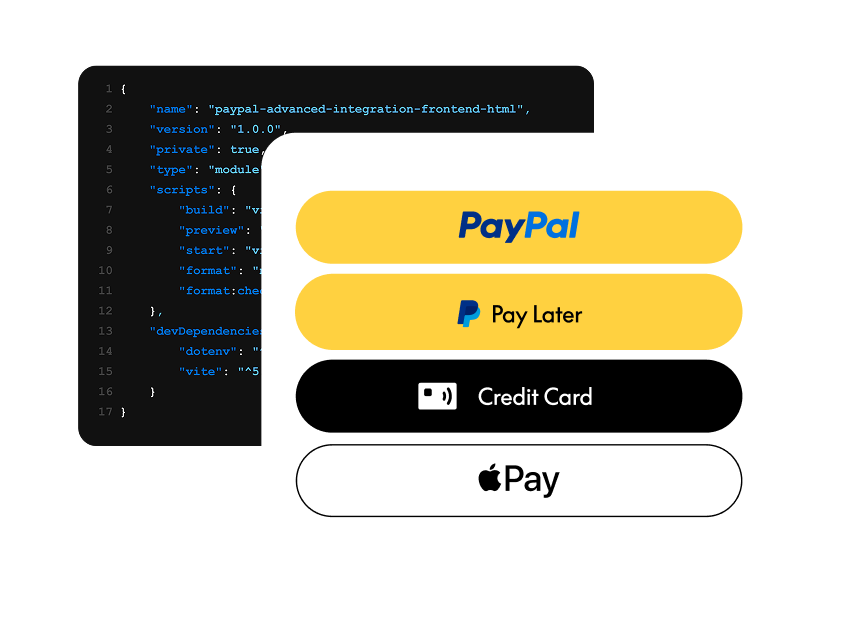

轻量代码,合规无忧,让您专注业务本身

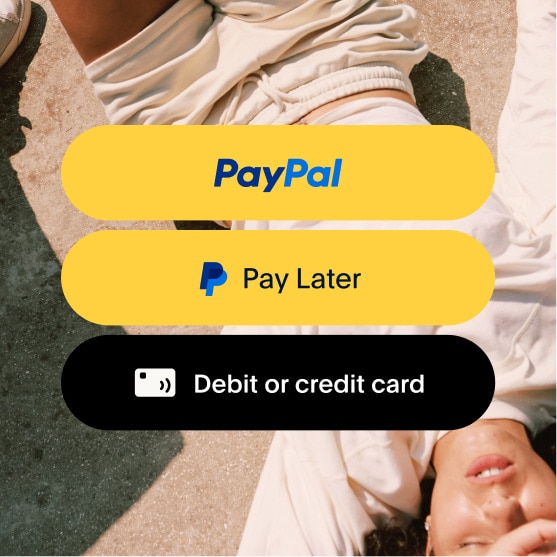

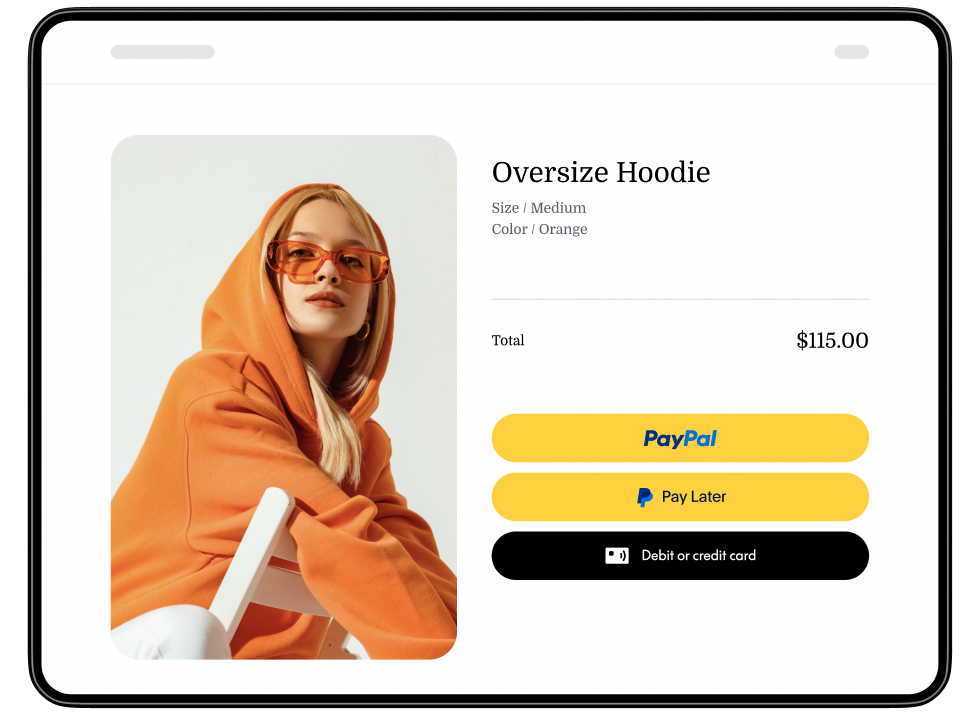

同时支持PayPal和信用卡借记卡支付

既支持PayPal支付方式(如PayPal支付按钮,PayPal Pay Later先买后付等),又能通过PayPal支付通道支持信用卡和借记卡进行海外收单。

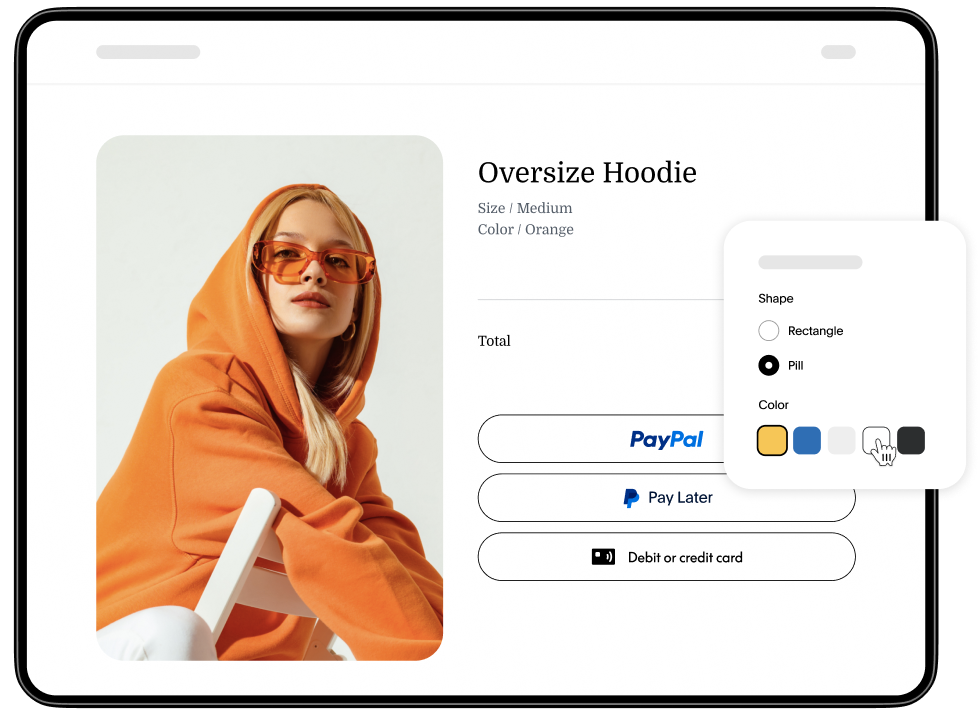

简便的个性化定制

通过少量代码即可进行快捷简单的设计定制。支付按钮的形状和颜色都可以通过这一方式来适配您的品牌调性。

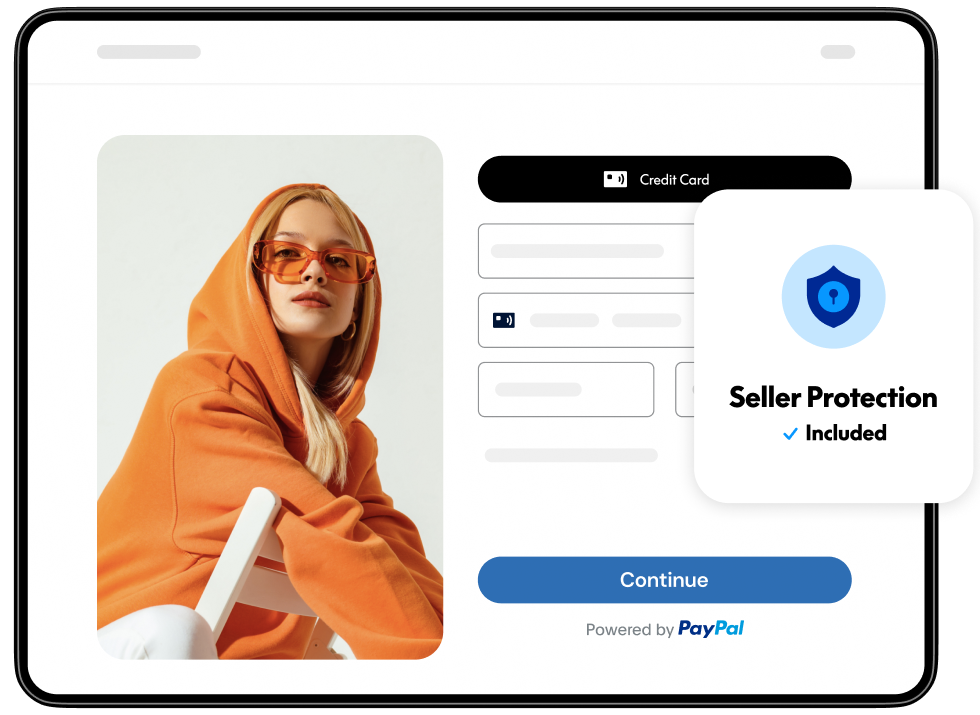

风险保障

PayPal提供的卖家保障服务4能帮助商户在符合要求的交易中避免退单、交易撤销和产生相关费用。

PayPal全球收单-标准版和PayPal全球收单-高级版有什么不同?

PayPal全球收单-标准版 | PayPal全球收单-高级版 | |

支付选项 |

|

|

结账流程定制化 | 可简化结账流程的基本自定义功能,如自定义付款按钮的颜色和形状 | 可以定制结账流程以适配您的品牌 |

风控管理 | 内置风险管理 | 商户自主管理,可以选择更多附加的风险管理服务 |

借助第三方代码,自主编码或无代码集成

总有一种集成方式适合你的跨境业务发展阶段