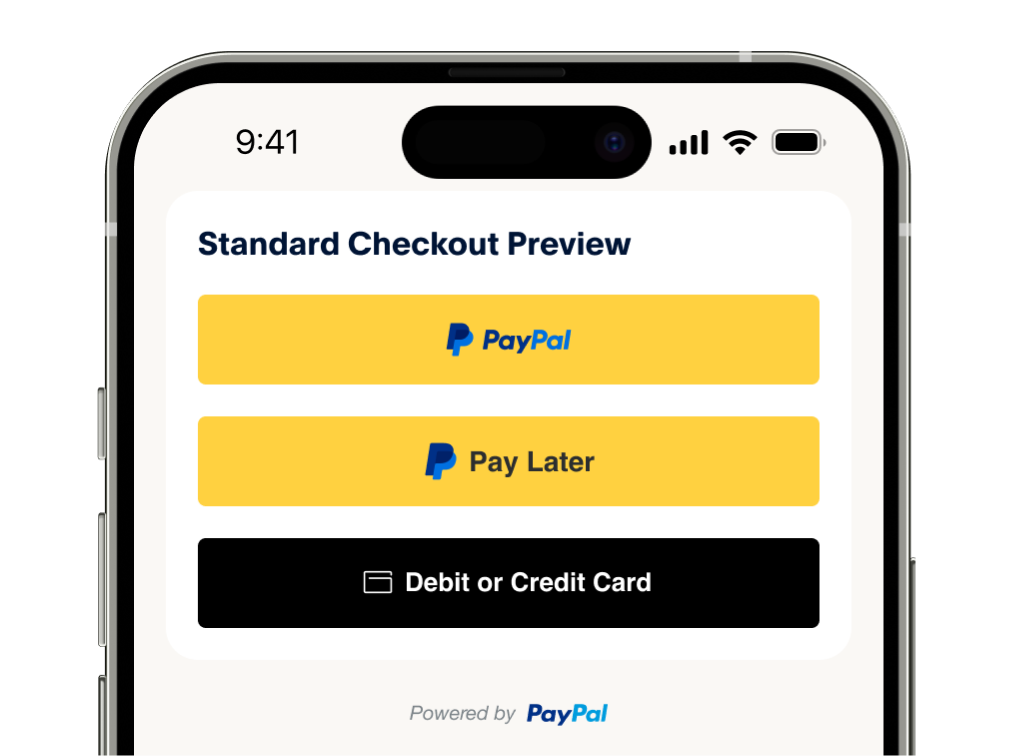

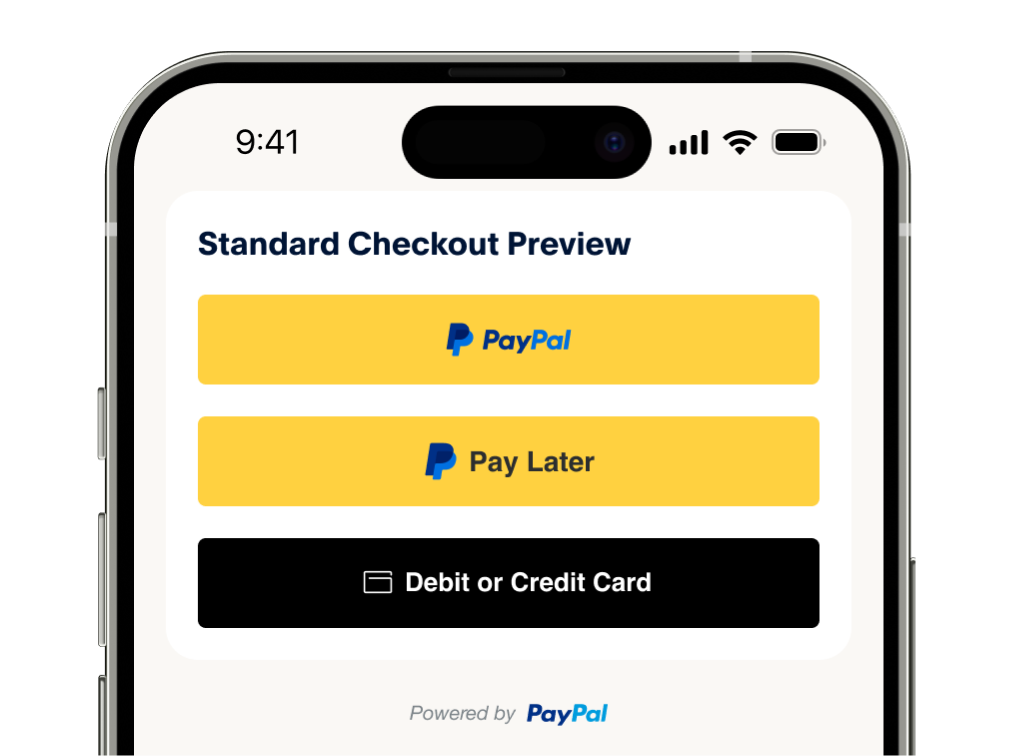

Standard Checkout solution

Includes PayPal, Pay Later, credit and debit card payment

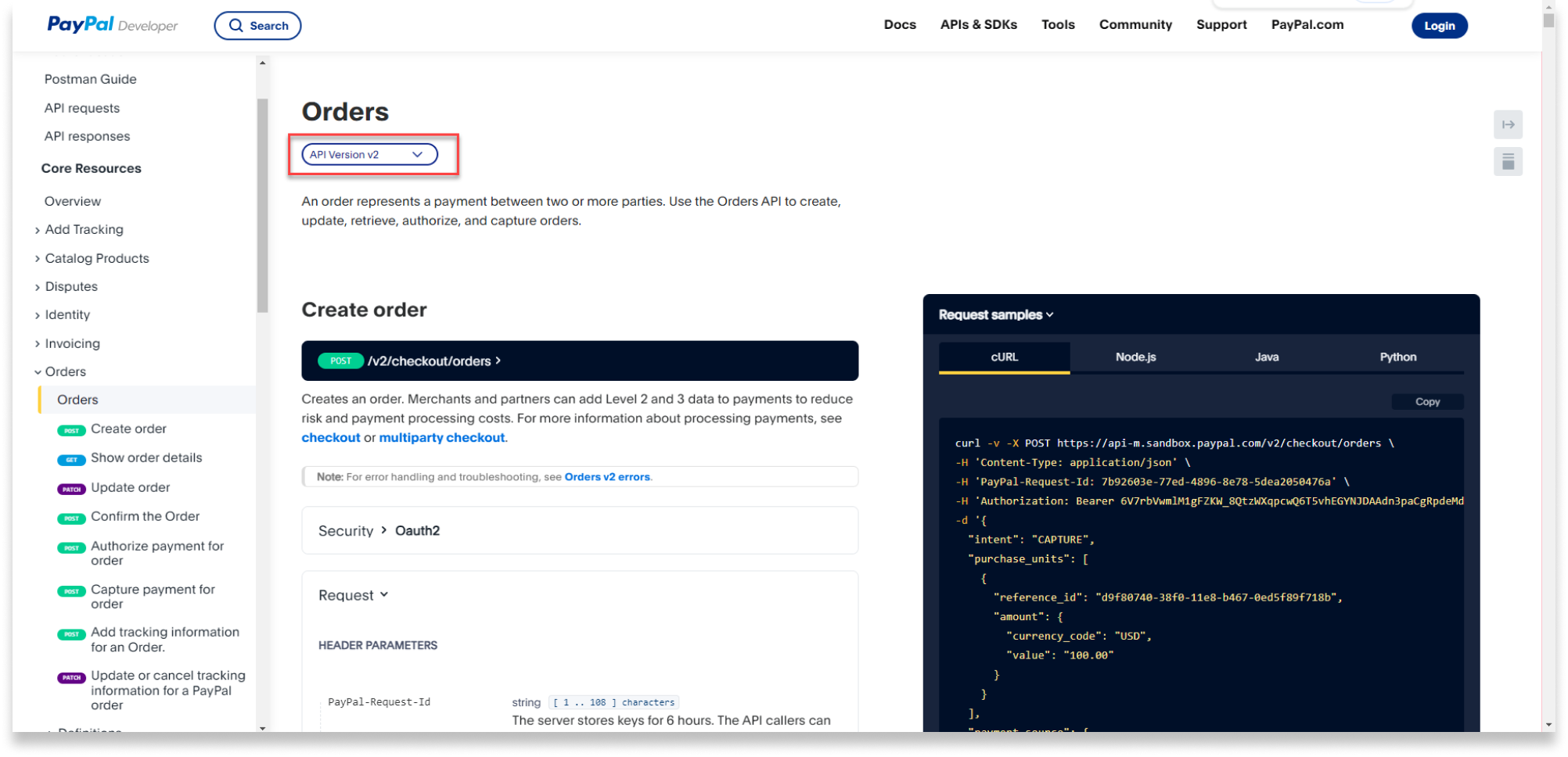

Unlock the latest features from PayPal and get ready for innovative features coming to PayPal Complete Payments*.

Includes PayPal, Pay Later, credit and debit card payment

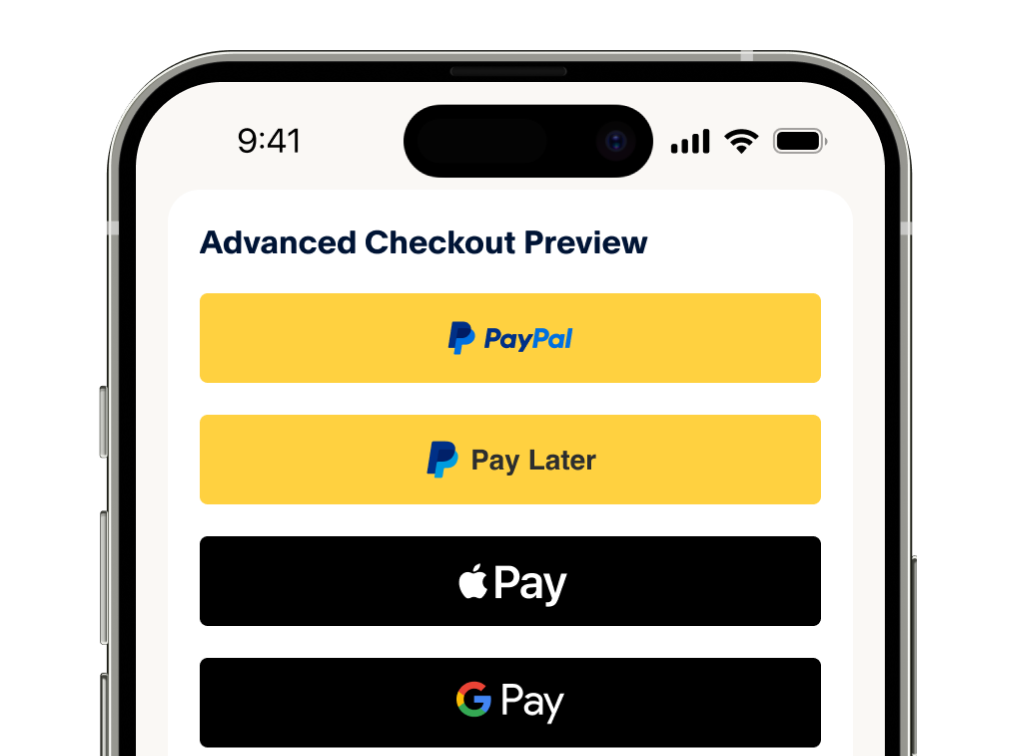

Includes PayPal, Pay Later, credit and debit card, Apple Pay**, Google Pay and alternative payment methods.

We'll use cookies to improve and customize your experience if you continue to browse. Is it OK if we also use cookies to show you personalized ads of PayPal China? Learn more and manage or reject your cookies