- Start selling goods & Services to global buyers

- Accept global and local payment methods

- Customise the styling of your checkout

- Present your payment form in the local language of your shoppers with our localization support

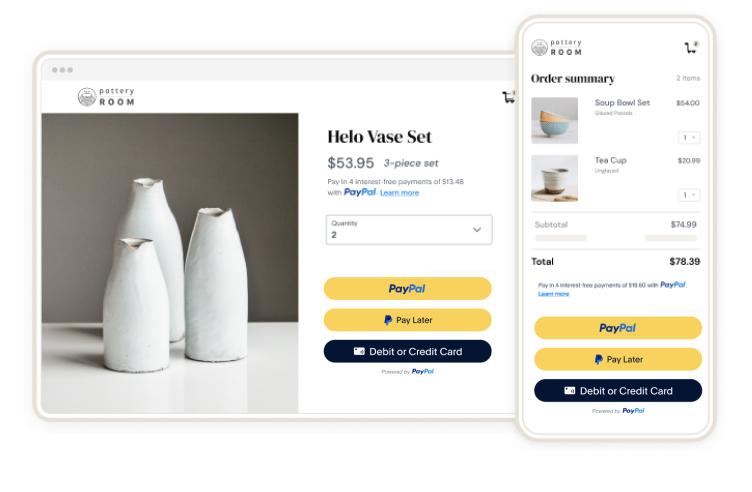

- PayPal payments (PayPal, Pay Later options, alternate payment methods and more)

- Credit and debit cards stored in your customer's PayPal Wallet

- Credit and debit cards through guest checkout—no PayPal account needed

- Recurring payments for your subscription sales

- Nearly 200 countries and regions

- Process payments in 23 currencies

- Simplified PCI compliance since payments are managed by PayPal

- Seller Protection for PayPal payments to help protect you from fraud

- Verify transactions with two-factor authentication through 3D Secure

- Customize the color and shape of our payment buttons

- Mobile-friendly user experience so customers can easily shop on any device

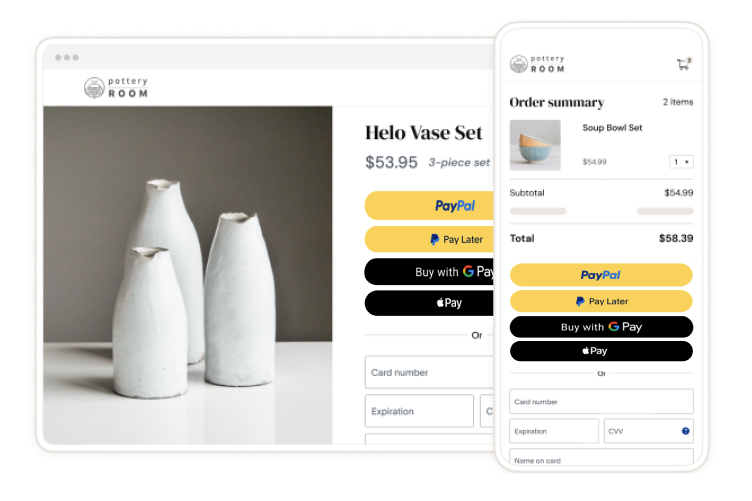

- PayPal payments (PayPal, Pay Later options, alternate payment methods, and more)

- Accept credit and debit cards directly on your site

- Offer Apple Pay and Google Pay as payment options to help drive conversion

- Save recurring payments for your subscription sales

- Process debit and credit card payments in 22 currencies

- Vaulting Payment methods

- Nearly 200 countries and regions

- Help meet global compliance standards like PCI SAQ-A and PSD2

- Get additional security insights with Fraud Protection on eligible transactions

- Get Seller Protection for eligible PayPal payments transactions1

- Optional Chargeback Protection to help reduce fraudulent costs and more Planned feature

- Verify transactions with two-factor authentication through 3D Secure

- Tailor your checkout flow to fit your brand

- Save customer cards and Apple Pay info for recurring payments and subscriptions

- Accelerate guest checkout with Fastlane by PayPal Planned feature

- Mobile-friendly flow so customers can easily shop on any device

- Drive authorization rates and reduce declines to help capture every sale

- Process payments using network tokens that have been provisioned by another token service provider

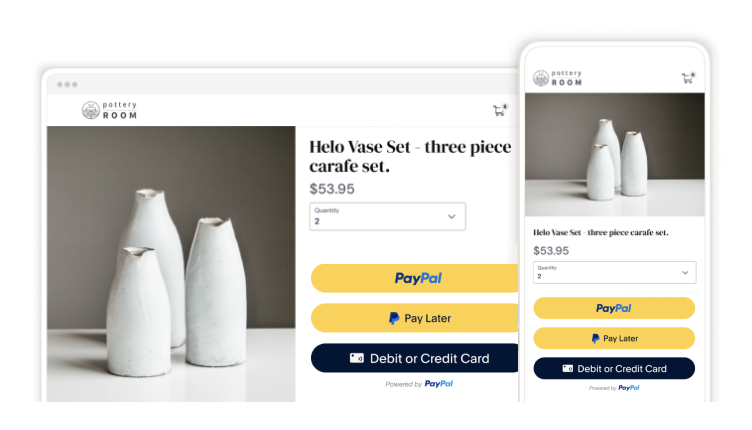

- Accept PayPal(QR Codes, Payment Links, HTML integration)

- Nearly 200 countries and regions

- 23 currencies

How to Integrate

1.Log into the PayPal Developer Dashboard, toggle Sandbox, Create sandbox business and personal accounts.

2.Go to Apps & Credentials, in REST API apps, create a new app.

3.Integrate the JavaScript SDK.

4.Integrate PayPal Standard Checkout.

5.Adding webhooks. Optional

6.Customize the Checkout experience. Optional

Testing

Test your integration in the PayPal Sandbox environment.

Go-Live

If you have fulfilled the requirements for accepting PayPal Payments for your business account, review the Move your app to production page to learn how to test and go live.

How to Integrate

1.Log into the PayPal Developer Dashboard, toggle Sandbox, Create sandbox business and personal accounts.

2.Go to Apps & Credentials, in REST API apps, create a new app.

3.Get approval for Advanced checkout.

4.Integrate the JavaScript SDK.

5.Integrate Advanced PayPal Checkout.

6.Adding webhooks. Optional

7.Customize the Checkout experience. Optional

8.Adding Apple Pay. Optional

9.Adding Google Pay. Optional

10.Save payment methods. Optional

Testing

Test your integration in the PayPal Sandbox environment.

Go-Live

If you have fulfilled the requirements for accepting PayPal Payments for your business account, review the Move your app to production page to learn how to test and go live.

How to Integrate

Testing

1.Signup / Log into PayPal Portal.

2.In Pay & Get Paid, click on Pay Links and Buttons.

3.Click on Back to Saved Links and Buttons to view created buttons.

Go-Live

Copy and paste the buttons, pay links, or QR codes wherever you need them.

Click to download PDF file for full content